Sign Company Canada. Custom Signs Canada. Best Sign Company in Canada. National Neon Signs Contractor. Sign Company Near Me. Sign Services Canada.

Providing Businesses Like Yours With Commercial Sign Solutions in Canada For More Than 70 Years

Take advantage of the space around you and attract your ideal customers with the right sign for your business. As a leading Sign Company in Calgary, we would be happy to help you find the right sign for you, ensuring it perfectly represents your brand and captures the attention of your target audience.

National Neon Displays Ltd. Fabricating Quality Business Signs in Canada Since 1949

"National Neon has emerged as one of Canada’s premier Sign Companies, including being a top choice as a sign company in Edmonton and a leader in Digital Signs across Canada. Operating nationwide, we provide functional, integrated, and advanced sign solutions to our clients. From Concept to Completion, National Neon offers a true turnkey service system that accommodates all signage needs & demands, while delivering a quality customer experience. Whether you’re in need of traditional signage or the latest in digital signs in Canada, we have the expertise to bring your vision to life.

Our Most Popular Signs - What We Can Do For You

Signage Industries We Work With

Hotel Signs | Hospital Signs | Airport Signs | Retail Signs | Restaurant Signs

Our Scope of Signage Services in Canada

What they say

james clouthier

National Neon is fantastic! Christine was a pleasure to deal with, and everything arrived on time and in perfect order. I would be happy to engage them for any future projects!

Mint Smartwasher

National Neon's quality craftsmanship, willingness to do what it takes and customer service made it an easy decision to work with their team and make them our signage partner for our car wash expansion.

Our completed projects, showcasing custom digital LED signs, wayfinding solutions, and freestanding signs designed to meet the unique needs of our clients

LED Signage first and foremost grabs the consumers attention while allowing you to be more creative with your real world advertising campaigns.

It’s an advertising medium where businesses are free to explore different ways of presenting value propositions to their target audience - without the limitations of design space traditional signs have.

LED Signage is the future (and present) of real world advertising.

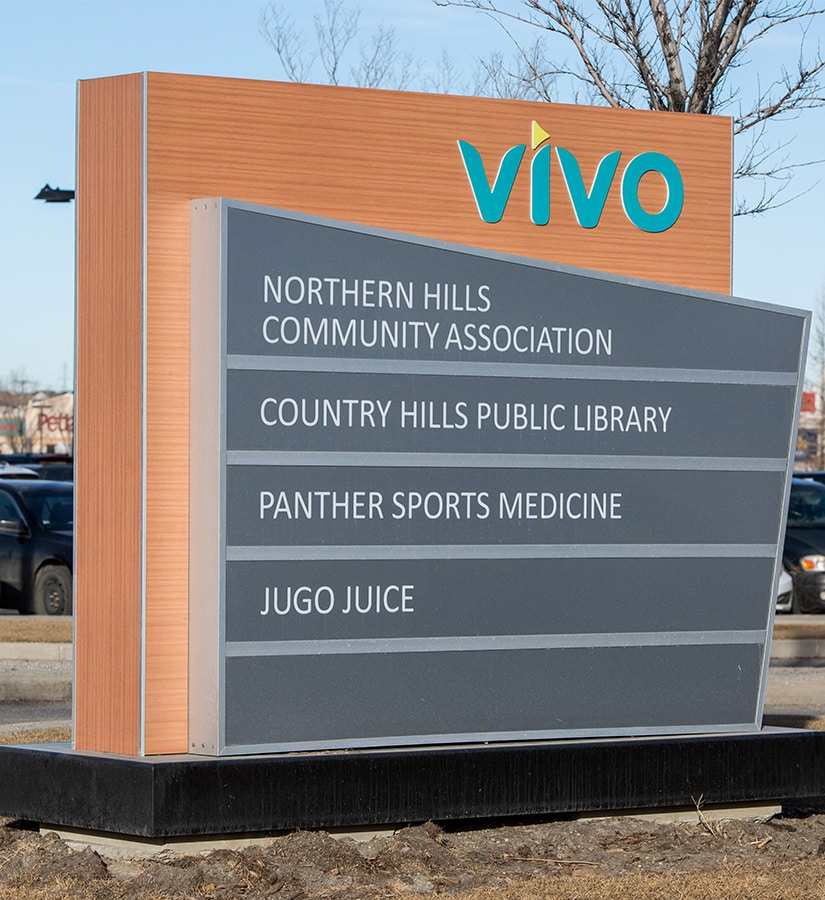

Wayfinding Signs makes it easy for people to understand where they currently are, and see what facilities, amenities or businesses are nearby.

It’s not just about helping people to not get “lost”, but making it easy for anyone to go from point A to B.

This type of signage is essential for offices, malls, airports, or large sporting venues

Freestanding Signs have been around for decades - because they work!

They are meant to grab the attention of people on the street, create a sense of industry dominance for a business or property, and provide a marketing and branding platform that gets easily noticed.

Design

At National Neon Signs we work with you and your business to design your sign concept.

Install

After the design is finalized, we will install the signage for you.

Repair

We offer repair services to make sure that your business always looks its best.

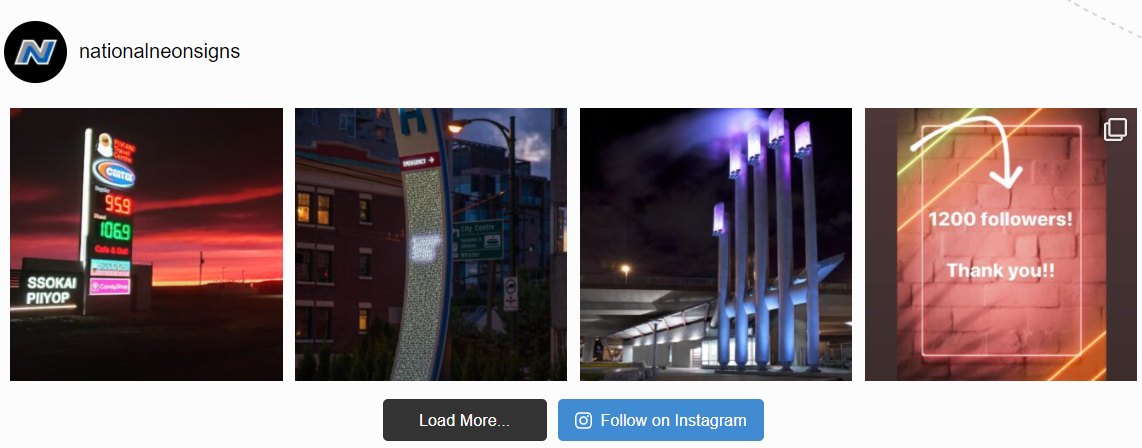

Check Out Our Canadian Signs on Instagram

National Neon Signs - Contact Centre

Get in touch with a sales representative today.

Fill out your sign project details below and we will get back to you as soon as we can.